The FedEx Story: How a 'Hard Pass' Idea Became a $53 Billion Business

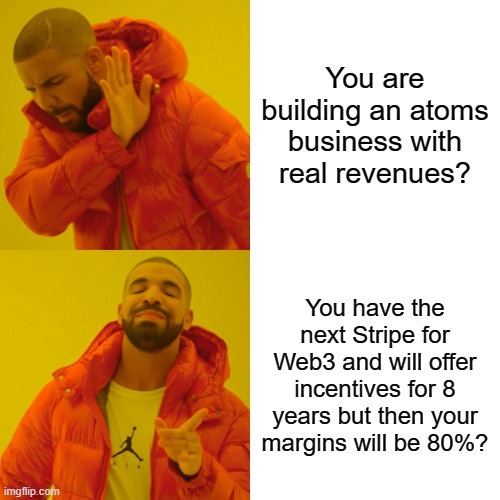

A key question whenever I encounter a new pitch deck is to test the scalability of the solution. At a certain faraway point in time – would the startup have enough operating leverage (ratio of fixed costs to variable costs) to return enough to meet VC like power law returns. This, for most investors, has translated to backing similar looking software businesses (that demonstrate operating leverage - bits businesses) and ignore capital/human-intensive businesses (atoms business).

Now, I feel it is worth to play devil’s advocate to this tendency of mine – I will do this by sharing a story of a founder winning.

If today, a startup starts by pitching that they are going to purchase airplanes with funding and run an airline company to ensure ‘overnight delivery of parcels’ – most VCs (including I) would be inclined to say ‘Hard Pass’ before someone hits page 2 of the pitchdeck. Furthermore, the founder shares how they were in the Marines fighting the Vietnam war and had absolutely no experience in the airplane industry. It was true category creation (overnight delivery wasn’t the norm) and going against USPS, a government backed behemoth.

My reasons would be as follows - Running an airlines is one of the most operations-intensive business. This in itself, coupled with purchasing airplanes, ensuring their maintenance and dealing with depreciation - it sounded like a ‘one way ticket’ to a writeoff. It is a classic ‘atoms’ business. No wonder, even Warren Buffet and Richard Branson, the erstwhile CEO of Virgin Atlantic have quipped, “How to be a millionaire? Start as a billionaire and then buy an airline.”

Yet, in 1972, I would probably have lost out on the opportunity of the year – Federal Express with this attitude. Fred Smith’s (FedEx’s founder) entrepreneurship professor at Yale gave his then startup idea of Fed Ex, an overnight delivery service (C-) . The professor probably absorbed some of my seemingly ‘rational’ attitude.

Fred, however, continued on and launched his startup by buying 14 Falcon Dassault-20 airplanes to start delivering parcels overnight v/s the traditional 2-3 day delivery by USPS. For this, he raised $40 million in venture capital from Citicorp Venture Capital, General Dynamics, New Court Securities, AllState Insurance and his own money. On their first day of operations – FedEx delivered 189 packages. For the first four years, FedEx didn’t make a single dime – and continued to run on venture capital and lose money till 1976, where they saw their first profit of $3.6 million (with a volume of 19,000 packages a day). FedEx is now – a $53 billion business (publicly listed in 1980) and USPS has caught on and has been doing overnight deliveries since 1980.

Despite, this episode – it is still great to demonstrate scalability or atleast, eventual scalability if you can. But, if you have businesses that involve people-led sales motions or capital-intensive operations, it could be useful to show how you will still have a distinct advantage (like FedEx’s category creation story and/or unfulfilled consumer demand). DM me if you feel I can help.

And for me, the lesson is to be aware of the FedExes lurking around me! If you liked this, consider following me on Twitter.